Accelerate decisioning.

Eliminate manual friction, completing core verification in under 30 seconds, letting you automate data workflows, increase accuracy, and reduce manual headcount.

Verify user-provided data from the source to automate data workflows, increase user engagement & acquisition, and reduce fraud.

Powering verifications for:

Eliminate manual friction, completing core verification in under 30 seconds, letting you automate data workflows, increase accuracy, and reduce manual headcount.

Replace fraud-prone documents with cryptographically source-verified facts, achieving up to 99.9% fraud reduction. This drastically reduces OpEx and eliminates costly mistakes.

Receive cryptographically proven signal of truth without ever storing sensitive PII. This design ensures the platform is fundamentally GDPR-ready and secure by design.

All the tools needed to automate trust

Win high-value customers from your competitors with 100% verified status matching and zero fraud risk.

Instantly verify active membership and loyalty tiers to unlock exclusive benefits, without handling or exposing sensitive data.

Confirm account ownership and subscription activity instantly, enabling seamless service transfer or co-marketing.

Verify identity attributes (age, name) directly from the source without ever seeing or storing the document.

Validate degrees, certifications, or student status instantly and without reliance on manual registrar checks.

Prove current address or tenancy in real-time using source data, bypassing high-friction document uploads.

Verify current employment status and role directly from HR portals, eliminating hiring fraud and accelerating decision-making.

Verify real-time cash flow and income instantly for loan underwriting, eliminating the need for stale credit reports.

Stop wasting time and money on manual reviews, old paperwork, or blurry screenshots. Burnt replaces slow, high-friction processes with a simple 30-second digital check that eliminates data liability.

Your customer sees an offer or an application requirement and clicks a button to start the secure verification

The user logs into their own account—such as a bank, payroll portal, or loyalty program—through a secure, private window.

While the user is logged in, our system finds the specific fact you need directly from the source (e.g., "Company Name: Spooky Development").

You receive a simple "True" or "False" signal immediately, allowing you to approve an application or unlock a reward in real-time.

You never see or store the user’s passwords or private data. You only get the specific proof you need, which reduces fraud by 99.9%.

Step 2: Lead Capture.

Before the cryptographic verification begins, the user provides basic professional details (Name, Job Title, Work Email) to establish the record in the company's CRM.

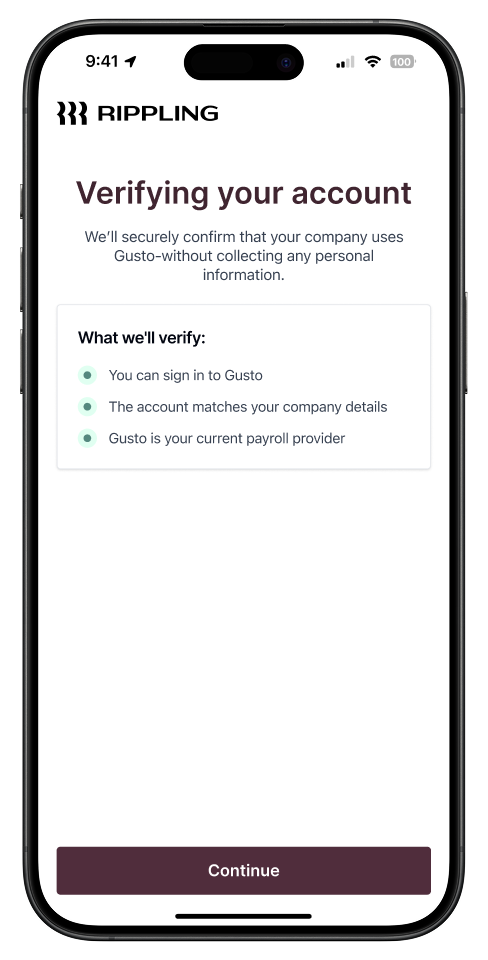

Step 4: Verification Consent.

The system clearly outlines what will be verified such as current payroll provider status while reassuring the user that no personal data or PII is collected during the process.

Step 6: Data Fact Extraction.

This is where the magic happens, while the user is logged in, burnt extracts specific, cryptographically proven facts (e.g., Company Name: Spooky Development, Employee Count: 805) to validate eligibility.

Our platform is built to be GDPR-ready, minimizing data liability by verifying facts without storing PII. For maximum assurance, we are actively pursuing AICPA SOC 2 and ISO 27001 certifications.

Stop wasting your budget on guesswork and manual reviews. Whether you are looking to acquire high-value customers or slash your underwriting costs, our technology delivers the truth instantly.

Yes, the implementation can take less than 48 hours. Unlike legacy integrations that take months to scope and implement, our platform is easy to integrate, and comes pre-loaded with the verifications you need. Many targeted use cases can move from initial scoping to a live Pilot Launch Plan within mere days.

We use advanced mathematics and cryptography - specifically Zero-Knowledge Proofs (ZKPs). This technology allows the user to prove a specific fact (e.g., "I have Gold Status" or "My Income is over $100k") directly from the source portal, generating a verified proof that you receive, all without you ever viewing or storing the raw PII or login credentials. The user is also unable to tamper with the source data in any way.

Yes. Because our technology is built on privacy-preserving architecture, it fundamentally reduces your data liability. You are not acquiring, storing, or handling the PII itself - you are only receiving a cryptographic confirmation of a fact.

Manual document review (proxy verification) is susceptible to forgery and human error. We eliminate this risk entirely by generating proof that is source-verified - meaning the signal comes directly from a trusted first-party data source (e.g., a bank's website or a registrar's portal). This approach achieves up to 99.9% fraud reduction and automates verification within seconds.

You can think of our platform as the 'Plaid for any data', not just financial data.

Another key aspect is that we do not pull or store the raw data - we simply provide a privacy-preserving mechanism to verify a single truth (a fact) about that data. This vastly simplifies all GDPR and user-data handling requirements.